Your Tax Sorted, The Eazi Way

Your Trusted Tax Partner

At Eazitax, we focus on a human approach, ensuring you’re always supported by real people, not robots. With direct phone support and personalised service, we build strong relationships and are always available to assist you when needed.

We combine tech-savvy solutions with classic values, catering to both traditional and digital preferences. With UK-wide coverage, we’re always there to provide the support you need, wherever you are.

Tax Return Services Tailored to You

Individual Tax Returns

Limited Company Accounts

Industry-Specific Services

Why Choose Eazitax?

Expertise

Personalised Service

Time-Saving

Peace of Mind

Transparent Pricing

Client-Focused Approach

Our Clients Love Us

We love them more

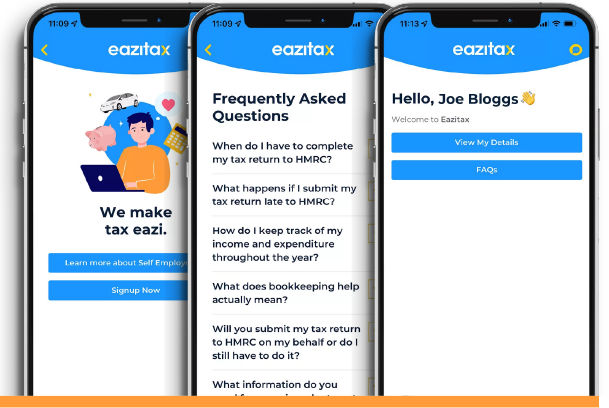

Manage Your Tax On The Go

It's so Eazi

Our intuitive app allows you to signup with our tax service, view your account information and contact our tax team. Our smart software will have your tax and accounts done in no time.

Get any tax question answered in minutes with our UK based team of accountants and tax experts.

You can spend less time on tax and more time on the things that matter. It’s that Eazi.

Tax Tips & News

Expert Advice

The case of PGMOL Ltd vs HMRC

The case of PGMOL Ltd vs HMRC is one of the more notable recent legal…

Making Tax Digital: What Private Hire Operators and Drivers Need to Know

In a major shift in UK tax administration, Making Tax Digital (MTD) is now on…

HMRC’s VAT Consultation: A Policy Built for Platforms, Not the Private Hire Trade

The Government’s recent Budget and HMRC consultation on VAT and private hire services has sent…

Ready to simplify your tax returns

Let us take the stress out of your tax returns, we’ll simplify the process, ensuring you get the maximum deductions while staying fully compliant!”