What is a phishing email?

Are you sure that email from HMRC is actually from HMRC? Businesses are often targeted by cybercriminals via emails designed to look like they came from a legitimate organisation. In these emails, the sender will ask the recipient to click on a link or download an attachment where the hacker will attempt to obtain your personal data.

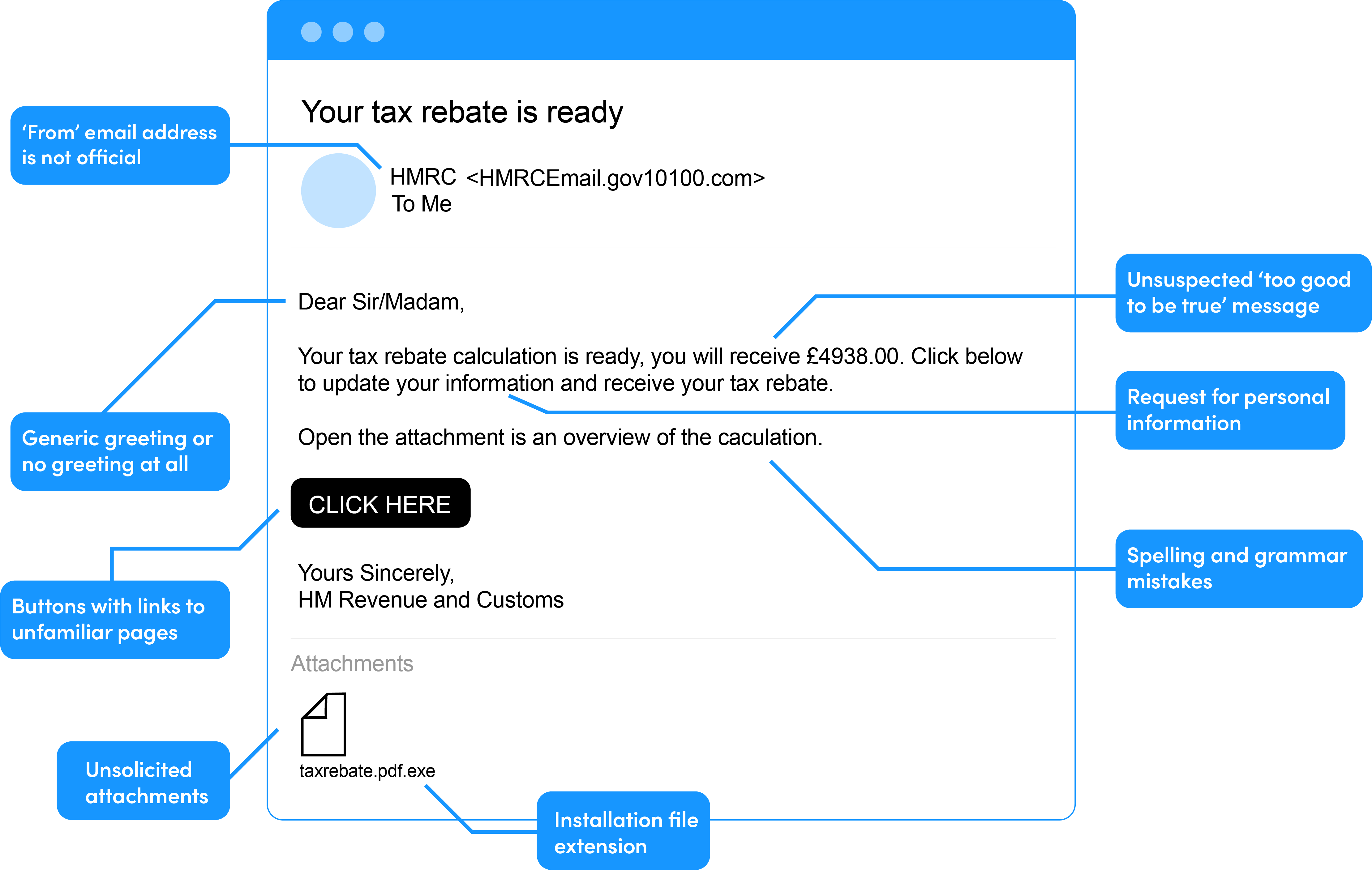

Signs of a Phishing Email

Requests for personal information, generic greetings, misspellings, unofficial ‘from’ email addresses, unfamiliar webpages and misleading hyperlinks are the most common indicators of a phishing attack.

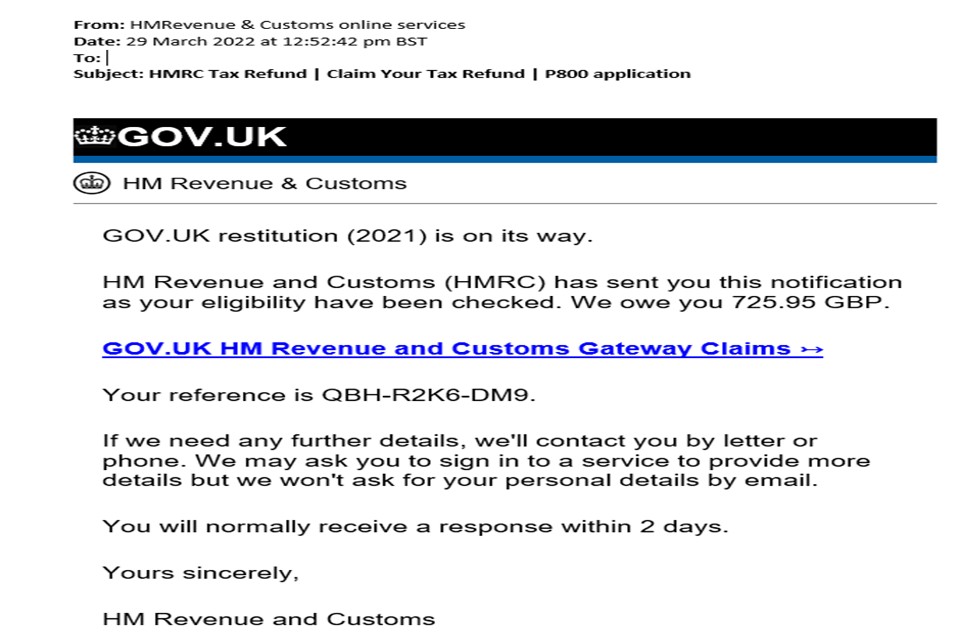

Example of a HMRC phishing email

HMRC have provided examples of phishing email and misleading websites. HMRC will never send notifications by email about tax rebates or refunds.

Do not:

- visit the website

- open any attachments

- disclose any personal or payment information

Fraudsters may spoof a genuine email address or change the ‘display name’ to make it appear genuine.

Things to consider when you receive an email

- Were you expecting the email?

- Inspect the full sender address, does it correspond with who the suggested sender is?

- Inspect the links in the email, do they redirect you to a file sharing service which isn’t obviously associated with the sender?

- The email content: Are there spelling or grammatical errors, or dates and times that don’t match?

- Do the attachments’ file extensions (suffix at the end of the file name) end with ‘.exe’, ‘.msi’ or ‘.dll’? These show that the file will install software when clicked on. Files like zip files can also disguise malicious files

- If an attachment or download is a Microsoft document, try not to be tricked into clicking an ‘enable content’ button, which can enable malicious actions.

What to do if you receive a suspicious email from Eazitax

Cybercriminals may pose as trusted associates such as your accountant, if you receive a suspicious email which is sent from Eazitax you should firstly not click on any links or download an attachment but call our office on 020 8529 2600, we’ll confirm if the email is in fact genuine or if it should be deleted.

Reporting internet scams and phishing

Misleading websites, emails, phone numbers and text messages can be reported to the National Cyber Security Centre (NCSC) by forwarding the email to report@phishing.gov.uk or forward the text message to 7726 – it’s free.